In the modern world, where financial transactions are increasingly conducted online, ensuring the security of sensitive financial information has become paramount. The Payment Card Industry Data Security Standard (PCI DSS) guides businesses worldwide towards the secure handling of payment card data. Compliance with PCI DSS not only protects your customers from potential data leaks but also safeguards your organization’s reputation and credibility. However, meeting PCI DSS compliance requirements and preparing for the audit process can be tricky.

In this comprehensive guide, we cover the best practices to help you prepare for the PCI DSS audit process and maintain compliance.

PCI DSS: main requirements

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect and secure cardholder data and the integrity of payment card transactions. It was developed by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB. The PCI DSS applies to all entities that store, process, or accept debit/credit card information.

Since its introduction in 2004, the PCI DSS has significantly evolved. The latest release, PCI DSS v4.0, includes twelve technical and operational requirements:

It’s vitally important to meet PCI DSS requirements as they address security vulnerabilities and potential points of compromise that could lead to data breaches and fraudulent activities.

If a company violates PCI DSS requirements, penalties can be harsh and reach up to $100,000 per month depending on the size of the organization and the scope of non-compliance. Moreover, banks may increase transaction fees or terminate their relationship with an organization that doesn’t comply with PCI DSS.

PCI DSS audit: who needs it

The primary goal of the PCI DSS audit is to verify that your organization has implemented the necessary security measures and controls to protect cardholder data during payment card transactions.

The audit process may differ according to their merchant-level status and payment brand. Generally, entities can be divided into four PCI DSS compliance levels:

| PCI DSS compliance levels | |

| Level 1 | Criteria:

|

Frequency of audit:

| |

Reporting documentation:

| |

| Level 2 | Criteria:

|

Frequency of audit:

| |

Reporting documentation:

| |

| Level 3 | Criteria:

|

Frequency of audit:

| |

Reporting documentation:

| |

| Level 4 | Criteria:

|

Frequency of audit:

| |

Reporting documentation:

| |

As you see, only entities that process over six million payment card transactions per year must be audited for PCI DSS compliance on-site. Organizations that handle a smaller scale of data may need just to fill out a self-assessment questionnaire and complete an attestation of compliance form that can be found on the official PCI website.

If an organization of any level experiences a data breach or cyber-attack that compromises payment card information, it needs to pass a yearly on-premise audit to ensure PCI compliance. Now, let’s check how to comply with a PCI DSS audit, who performs it, and how to prepare your business for a PCI DSS audit.

Who performs an audit?

A Qualified Security Assessor (QSA) performs a PCI DSS audit. QSAs are verified by the PCI DSS council and know their best practices and standards of data security.

Note that a PCI DSS auditor is responsible for preventing cardholder data from being compromised, not for penalizing an organization. The auditor looks into various areas of your organization including your cardholder data environment and policies outlining the use of your critical systems. The auditor will also tell you how to improve your cybersecurity and may even assist you with this process.

Preparation for a PCI DSS audit is an ongoing and continuous process that requires a comprehensive strategy. To help you out, we’ve narrowed down a list of the best practices to get ready for the audit.

Key steps to prepare for a PCI DSS audit

To successfully undergo a PCI DSS audit, organizations need to take essential steps to assess their security measures, address vulnerabilities, and demonstrate adherence to the rigorous standards set by the industry. In this section, we outline the key steps that will guide you on how to prepare for a PCI DSS audit effectively and ensure the security of your payment card transactions.

1. Adhere to the latest standard

Keep up-to-date with the most recent requirements.

PCI DSS is an ever-evolving standard that aims to adapt to emerging technologies, threats, and changes in the payment industry. The Payment Card Industry Security Standards Council constantly updates this standard to solve new security problems and challenges. Merchants and service providers should comply with the latest PCI DSS v4.0 which was released on March 31, 2022.

| The main changes in PCI DSS v4.0 | |||||

| Access privileges require biannual reviews | Third-party accounts must be regularly monitored | Account passwords must consist of a minimum of 15 characters | |||

| Multi-factor authentication (MFA) is mandatory for all user accounts that have access to sensitive card data | All passwords used for payment systems must be changed annually and in case of a data breach | ||||

Taking into account these changes, you should understand that even if your organization was PCI DSS compliant before, it won’t be automatically compliant after the release of PCI DSS v4.0. Consider reviewing the PCI DSS updates regularly. Once new requirements appear, you should identify compliance gaps and update your information security policies and procedures.

2. Conduct a cybersecurity risk assessment

Know your weak points.

Since the main goal of PCI DSS compliance is to reduce the risk of cardholder data breaches, you should assess your risk levels and get a clear picture of the potential vulnerabilities.

Cybersecurity risk assessment is a practice that can help you identify threat sources and evaluate your data’s level of protection. Thorough risk analysis will provide your security team with detailed insights into the vulnerabilities in your IT system. After identifying all weak points, your security team will be able to plan and prioritize threat remediation by the risk levels posed to your organization.

Make sure to conduct a detailed risk analysis of both hardware and software assets at least once a year and after every significant change in your network.

What to pay particular attention to:

- System failure. Check whether your critical systems are running on high-quality equipment and whether they have good firewall support.

- Human error. Make sure that your systems with cardholder data are properly configured. Also, verify that your education policies cover cybercriminal methods like malware, phishing, and social engineering.

- Adversarial threats. Assess risks posed by third-party vendors, insiders, and privileged users. Make sure you have robust access controls in place to limit who can access sensitive information.

When conducting a risk assessment, we recommend you take the following steps:

3. Establish robust policies and procedures

Policies and procedures account for many PCI DSS requirements.

A risk assessment will give you an understanding of your organization’s security posture, enabling you to establish effective policies and procedures to comply with PCI DSS. For example, you might create a new network security control rule that allows for connectivity between a system in the CDE and another system to bring additional networks into scope for PCI DSS.

Providing documentation on your security policies and procedures is also an important part of a PCI DSS audit. You need to document all encryption protocols, analytics, and procedures for storing information. Keep an ongoing record of any identified vulnerabilities, risks, changes in the system, and other relevant information. Examples of relevant documentation may include policies for:

- Data security

- Data management

- Data storage

4. Perform employee training

Employee awareness is a high-priority task.

After security policies and procedures are implemented, you’re ready to address the human element through employee education.

Train your employees on topics such as password protection and rotation, as well as the ways to detect phishing or social engineering attacks.

Ideally, you should perform training every 3-6 months or once your security protocols and practices are updated. In addition, you should conduct periodic checks on your employees’ cybersecurity awareness.

The PCI auditor may be looking for evidence of security awareness training, so make sure to record and document all information regarding employee security checks, updates, and methods of training employees on new security rules.

5. Monitor user activity within your IT infrastructure

It’s all about full visibility.

Monitoring user activity is a fundamental aspect of maintaining a secure and compliant environment when handling payment card data. It plays a vital role in safeguarding sensitive information, detecting potential threats, and demonstrating adherence to PCI DSS requirements during the audit process.

By monitoring user activity, you’ll be able to

- Detect any abnormal or suspicious behavior that may indicate unauthorized access.

- Identify unusual data transactions.

- Mitigate insider threats, both unintentional and malicious.

- Demonstrate compliance.

This activity can help you ensure the security and integrity of cardholder data and demonstrate to your auditor compliance with PCI DSS requirements.

6. Take care of your network

Know your network architecture.

Examining your network and making adjustments to it can ensure the security of data processing and maintaining compliance with PCI DSS.

You may either add firewalls or segment your network to improve your financial information security. For example, if you implement the network segmentation technique, you’ll segregate your network into self-contained subnetworks aimed at protecting cardholder data even if one subnetwork is compromised.

Take note that if you use multi-tenant architecture, your segmented networks will operate in a single environment, keeping each subnetwork’s data separate from that of other subnetworks.

7. Assess third-party compliance

Trust, but verify.

A significant number of data breaches occur due to vulnerabilities introduced by third-party service providers. According to PCI DSS compliance, organizations that outsource their cardholder data environment (CDE) or payment operations to third parties share responsibility with them.

Assessing PCI DSS compliance of your third-party service providers will help you identify potential weak points in their systems and enforce necessary security measures to prevent data breaches within your corporate network.

Keep in mind that third-party compliance assessments are not one-time events but an ongoing process.

How Syteca can help with a PCI DSS audit

Syteca is an all-in-one insider risk management platform that provides comprehensive monitoring functionality. It can significantly enhance the security of the CDE and increase visibility into user actions, thus aiding in passing an audit for PCI DSS compliance.

Password management. Syteca can help cover most of the rules from Requirement 2 (all system components must be configured and managed securely) thanks to rich password management functionality. Password vault, password rotation, just-in-time access, and other features ensure safe credential storage and rotation.

Identity management. Syteca allows organizations to define access policies and implement multi-factor and secondary authentication, as well as grant one-time passwords to control user access to critical systems and data. This will bring you into compliance with much of Requirement 8 for access control and identity management.

Privileged access management (PAM) With its robust PAM functionality, Syteca can help you ensure that access to critical system components and cardholder data is provided only to users who need to know it. Our software enables granting elevated access rights, providing granular access to the most secure assets, managing user credentials, specifying endpoints available for particular users, and more to help you meet PCI DSS requirements 7.1 and 7.2.

User activity monitoring. PCI DSS requires organizations to continuously monitor the security controls built into their CDEs. PCI DSS Requirement 10, in particular, demands that organizations log and monitor all access to system components and cardholder data. Syteca helps you achieve these objectives by collecting logs and continuously monitoring user activity.

Syteca monitors not only your employees but also third parties to make sure their actions comply with PCI DSS requirements. The platform provides a clear view of what your vendors do within your systems and how they handle critical data.

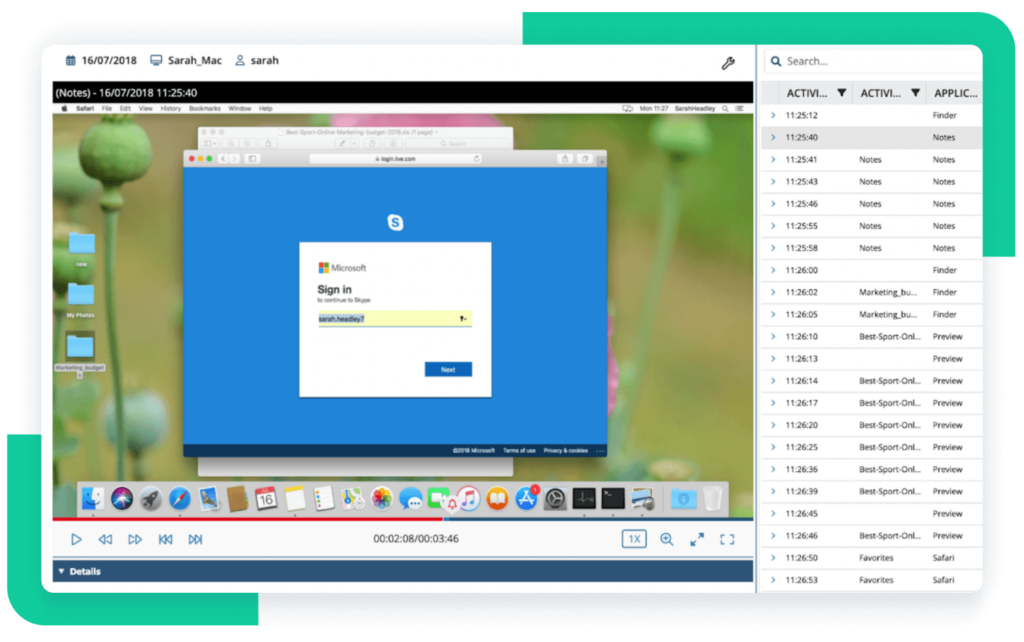

Session recording. Syteca’s session recording capability allows you to replay user sessions, thus providing a detailed view of user actions and interactions with sensitive data. You or a qualified security assessor can watch every action of your employees and third parties via a user-friendly YouTube-like player. This functionality can aid in post-incident investigations and facilitate forensic analysis if security incidents occur.

Audit trail report generation. Besides recording, collecting logs, and monitoring user activity on your endpoints, Syteca delivers audit trails that ensure an accurate and tamper-proof record of all user actions. These audit trails can serve as crucial evidence during a PCI DSS audit to demonstrate compliance with logging and monitoring requirements.

Syteca allows you to export monitoring results—you can export either a full or partial user session in a protected format for forensic investigation.

Insider threat detection and response. Syteca detects and alerts you to suspicious user behavior, identifying potential threats and cybersecurity incidents. You can also configure the platform to send customized real-time alerts when specific activities or policy violations occur. Therefore, your security team will be able to promptly respond to security threats by blocking users, terminating applications, and sending real-time notifications to pinpoint access abuse.

Data anonymization. To meet PCI DSS Requirement 3 regarding the protection of sensitive information, Syteca provides the ability to mask specific content during session recording and playback, ensuring that sensitive data is not exposed in recordings. All session data can be anonymized, including screenshots, user data, and metadata.

Conclusion

Preparing for a PCI DSS audit is not an easy procedure and it requires a comprehensive approach that addresses all requirements of the standard. By following the key steps outlined in this article, organizations can comply with PCI DSS audit requirements, enhance their security posture, mitigate risks, and demonstrate their commitment to safeguarding sensitive cardholder information.

Leveraging PCI DSS compliance solutions can strengthen your compliance efforts and contribute to a successful PCI DSS audit, ensuring the protection of cardholder data and enhancing customer trust. Ekarn System is a comprehensive solution that provides strong user activity monitoring, insider threat detection capabilities, and comprehensive audit trail generation. It can help you meet crucial PCI DSS requirements and protect valuable cardholder data.

In addition to PCI DSS, Syteca can assist you with meeting other requirements such as SOX, SWIFT, ISO 27001, and more.

Request a free 30-day trial of Syteca

and test its capabilities in your IT infrastructure!