As cyberattacks become more sophisticated, strong cybersecurity measures might not be enough to protect your organization. It’s not a matter of “if” cybersecurity incidents will occur but rather “when”. That’s why many organizations turn to cyber insurance for financial protection against cyber threats.

In this article, you’ll learn about what cyber insurance is, its benefits, and ways to prepare for a cyber insurance assessment to get comprehensive coverage at fair premiums for your organization.

What is cyber insurance?

Cyber insurance is a form of business liability insurance that protects organizations against cybersecurity risks. Since 1997, when it first appeared, cyber insurance has grown into a widely used instrument to protect organizations from enormous losses instigated by cyber threats, such as data breaches and cyber extortion.

The number of cyber threats is rising, as is the increasing damage they inflict on organizations across industries.

Furthermore, Cybersecurity Ventures expects global cybercrime costs to reach $10.5 trillion annually by 2025, which is $3 trillion more than in 2015. These costs include the losses organizations may face due to data destruction, theft of personal and financial data, intellectual property infringement, post-attack business disruption, mitigation and restoration activities, reputational damage, etc.

The consequences of cybersecurity incidents may be overwhelming for many organizations, so cyber insurance proves beneficial by providing organizations with financial security. Cyber insurance can help you reduce post-incident financial burdens by covering the costs of forensic investigations, legal assistance, and, in some cases, extortion payments. Some insurance providers go the extra mile and offer their clients advice on measures and tools to strengthen their cybersecurity.

Request access to the online demo of Syteca!

See how Syteca can help you enhance the security of your organization’s systems and data.

How does cyber insurance work?

Cyber insurance helps mitigate financial losses and liabilities arising from cyber incidents.

To receive cyber insurance coverage, organizations need to undergo a cyber risk assessment conducted by an insurance company. During the assessment, insurers evaluate the organization’s existing security measures and practices to identify the overall risk profile. Based on that information, insurers determine the scope of coverage and premiums appropriate for the organization as well as establish deductibles – the portion of a loss that the insured organization is obligated to pay out-of-pocket.

If an organization faces a cyber incident that is covered by its insurance policy, the insurer helps mitigate the losses. However, the types of losses covered can differ between insurance companies and the policies they offer.

What does cyber insurance cover?

There’s no standard for cyber coverage, as it is pretty dynamic. Insurance providers usually tailor their coverage to the specifics of the organizations they protect. Let’s examine the most common risks cyber insurance may cover:

Expenses often covered by cyber insurance

Data recovery and recreation

Business interruption

Transferred funds loss

Computer fraud

Cyber extortion

Network security failures

Personal data disclosure

Multimedia data breach

Notification costs

Forensic investigation

Credit monitoring

Reputational damage

- Data recovery and recreation – expenses organizations spend on recovering and reconstructing data required for their business operations.

- Business interruption – the losses organizations face due to disruptions of business operations, such as revenue loss.

- Transferred funds losses – financial losses due to unauthorized wire transfers or other fraudulent financial transactions.

- Computer fraud – losses sustained by social engineering techniques like phishing or vishing, impersonation, and pretexting.

- Cyber extortion – costs arising from cyber extortion and blackmail, including ransom payments, negotiation costs, and legal support.

- Network security failures – losses resulting from the exploitation of network security vulnerabilities leading to unauthorized systems and data access.

- Personal data disclosure – expenses stemming from unauthorized disclosure of personally identifiable information (PII) or protected health information (PHI) as a result of legal actions and settlements.

- Multimedia data breach – expenses related to unauthorized use or theft of multimedia content, including those classified as intellectual property.

- Notification costs – costs of identifying and notifying potential victims (i.e., customers and partners) about the cybersecurity breach.

- Forensic investigation – expenses of engaging forensics consultants to investigate the origin and extent of an incident.

- Credit monitoring – costs of an organization’s post-incident credit monitoring aimed at detecting potential identity theft or fraudulent activities.

- Reputational damage – costs related to the loss of customer trust caused by an incident and PR activities aimed at mitigating reputational damage.

What your cyber insurance policy will cover depends on your cyber risk score and the premiums you’re prepared to pay. The larger the scope of insurance policy coverage, the higher the premiums. Thus, getting broad coverage at a reasonable price is a challenge.

The challenge of qualifying for comprehensive cyber insurance coverage

Insurers have become more demanding and now need a comprehensive understanding of an organization’s cybersecurity practices before providing them with coverage. There are a couple of reasons behind that.

First of all, each year more organizations suffer from cyberattacks. Hiscox Cyber Readiness Report 2023 shows that 53% of firms suffer from cyberattacks, which is 5% higher compared to 48% of firms in 2022.

Secondly, the costs of cyberattacks for organizations are also on the rise. According to the Cost of a Data Breach Report 2023 by IBM, the average per-incident cost increased 15.3% from $3.86 million in 2020 to $4.45 million in 2023.

That’s why insurers now scrutinize organizations more closely when assessing their cybersecurity measures and provide comprehensive insurance policies only to those well-protected from cybersecurity risks. Consequently, you must either prepare for cyber insurance in order to get it for a reasonable cost, or pay high premiums — if not get rejected entirely. Now let’s review some of the best practices for cyber insurance assessment preparation that can help you overcome the challenge.

Best practices for cyber insurance preparation

To get comprehensive cyber coverage, you need to stay ahead of emerging threats, implement robust security controls, regularly update your security policies, and use other best security practices. Below, we review the most relevant security practices to prepare a business for cyber insurance assessment.

1. Assess cyber risks

Assessing current cyber risks in your organization is the first step in preparing for cyber insurance. You should identify, analyze, and prioritize your cybersecurity risks per their potential impact.

Cyber risk assessment will help you identify weak areas of your organization’s cybersecurity. After identifying and prioritizing cyber risks, concentrate your efforts on mitigating the most harmful potential security issues before applying for cyber insurance coverage.

It’s also vital to make cyber risk assessment a systematic practice in your organization to maintain strong cybersecurity and simplify the renewal of your cyber insurance coverage.

2. Develop and regularly update cybersecurity policies

Your organization’s cybersecurity policies can greatly influence your chances of getting cyber insurance coverage at reasonable premiums. Thus, you need to make sure you have all the necessary policies in place. For example, you can start by developing the following must-have policies:

Once you have developed and documented your policies, you need to review them regularly to identify gaps and obsolete security measures. Be sure to align the policies with current best practices, regulatory requirements, and insurers’ criteria.

3. Secure your IT environment and sensitive data

Organizations should also fortify their IT infrastructure to protect it against cyber threats. Consider using a firewall to control inbound traffic and protect your network from external dangers. It’s also vital to make sure that all the software you’re using is up-to-date. By updating software to the latest versions, you minimize the risk of cyberattacks via known vulnerabilities.

You may also consider implementing measures to secure your organization’s and clients’ data. For example, by performing regular data backups, you can protect your organization from data loss. At the same time, data encryption can prevent unauthorized access to sensitive data.

4. Employ multi-factor authentication

Multi-factor authentication (MFA) is one of the best practices for validating the identities of those accessing your organization’s resources and data. Industry regulations and laws, such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Health Insurance Portability and Accountability Act (HIPAA) recommend organizations use MFA to secure sensitive data.

Consider using two-factor authentication to verify the identities of users within your network. Syteca is a full-cycle insider risk management software that offers a cross-platform two-factor authentication functionality that allows you to authenticate users based on their knowledge of user credentials through a verified mobile device.

5. Limit access to sensitive resources

Managing and restricting user access to sensitive information is another important step in preparing for cybersecurity insurance coverage. Consider implementing the principle of least privilege to limit user access permissions to the minimum required for them to do their jobs. This way you can reduce the risk of malicious attackers accessing your organization’s sensitive systems and data even if they manage to compromise one of your accounts.

As an additional layer of security, you can implement zero trust architecture and request identity verification each time someone tries to access your critical assets.

Syteca’s privileged access management (PAM) functionality allows you to:

- Granularly manage access permissions for privileged and regular users

- Establish secure remote access to your organization’s endpoints for remote employees and third-party vendors

- Provide temporary access to sensitive resources with one-time passwords (OTP) and time-based user access restrictions

- Implement manual access request and approval workflow

With Syteca’s lightweight software agents, you can enforce effective access management without burdening your infrastructure.

Explore the power of Syteca!

Test how Syteca can help you secure user access to critical systems and data.

6. Establish user activity monitoring

Visibility into user actions within your IT infrastructure positively influences your risk score and improves your image in the eyes of insurance companies.

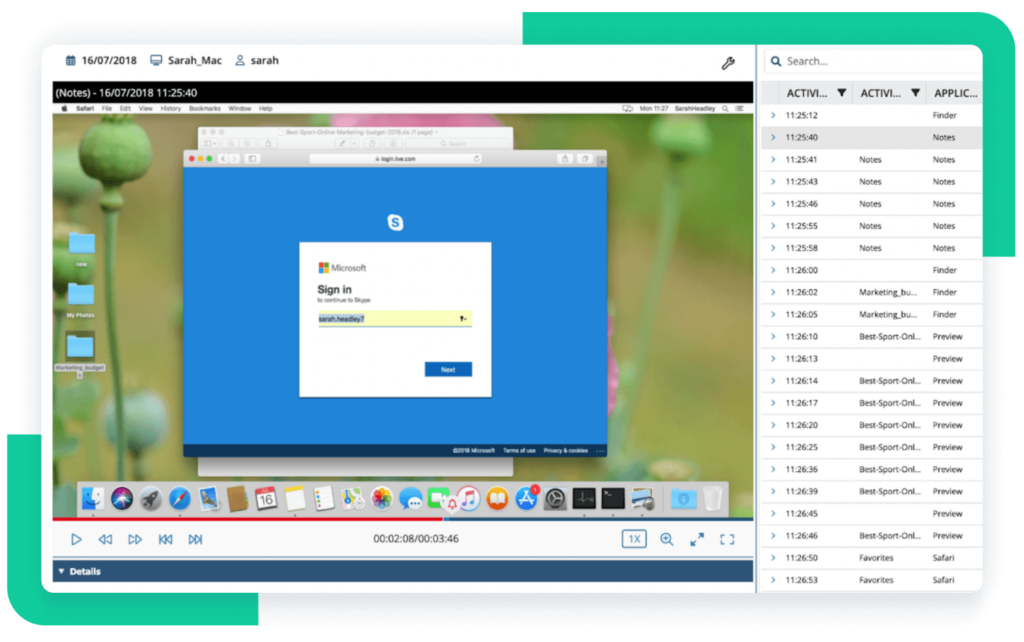

Real-time user activity monitoring (UAM) lets you take a proactive stance toward the management of cybersecurity risks and swiftly detect early signs of potential threats. With reliable user activity monitoring tools, you can respond to potential threats and stop cyberattacks before the damage is done.Sytecas’ continuous user activity monitoring enables you to:

- View sessions of local and remote users in real time

- Record screen captures of user sessions with insightful metadata that’s easy to search through

- Analyze user behavior and detect suspicious activity

- Receive real-time alerts about suspicious activity to take immediate action when needed

7. Create an incident response plan

An incident response plan (IRP) can become a significant asset in terms of cyber insurance assessment. An actionable IRP shows insurers that your organization is committed to proactive risk management and minimization of the impact of potential cyber incidents.

A comprehensive IRP should include the following information:

- Members of the incident response team and their responsibilities

- Communication protocols to follow in case of an incident

- Actions to take in the most likely incident scenarios

- Recovery guidelines for each of those scenarios

- List of authorities to report the incident to

When developing an IRP for your organization, you can follow the incident response planning guidelines provided by the National Institute of Standards and Technology (NIST).

Syteca can enhance your incident response efforts. With the automated incident response functionality, you can:

- Receive notifications about potential threats

- Show warning messages to users performing forbidden actions

- Automatically block users, USB devices, and dangerous processes

8. Comply with IT security requirements

Apart from enhancing your organization’s cybersecurity and protecting you from non-compliance fines, adhering to IT security requirements can improve your chances of getting a cyber insurance policy with favorable terms.

Before applying for cyber insurance, map IT security laws, standards, and regulations applicable to your organization and make sure your current security measures meet their requirements. Identify the gaps between your current security controls and the requirements, and implement lacking security controls and procedures. Only then should you apply for cyber insurance.

Syteca provides you with technological solutions covering many IT security requirements across various industries at once. With Syteca, you can streamline compliance with PCI DSS, GDPR, HIPAA, SOC 2, DORA, NIS2, and many others.

Conclusion

Long past are the days when companies could easily receive cyber insurance coverage. Insurers’ criteria for providing cyber insurance have expanded beyond mere compliance, demanding companies implement robust risk management strategies and continually improve their cybersecurity.

The best practices mentioned in this article can help your organization prepare for a cyber insurance assessment and strengthen your overall protection against cybersecurity risks. Syteca’s insider risk management capabilities can help you efficiently implement these security best practices and protect your organization from within.

Syteca’s insider risk management capabilities can help you efficiently implement these security best practices and protect your organization from within.